You’re digging through end-of-month reports to find out which payers aren’t paying.

business of diagnostics

Technology

Revenue

Revenue Cycle Assessment

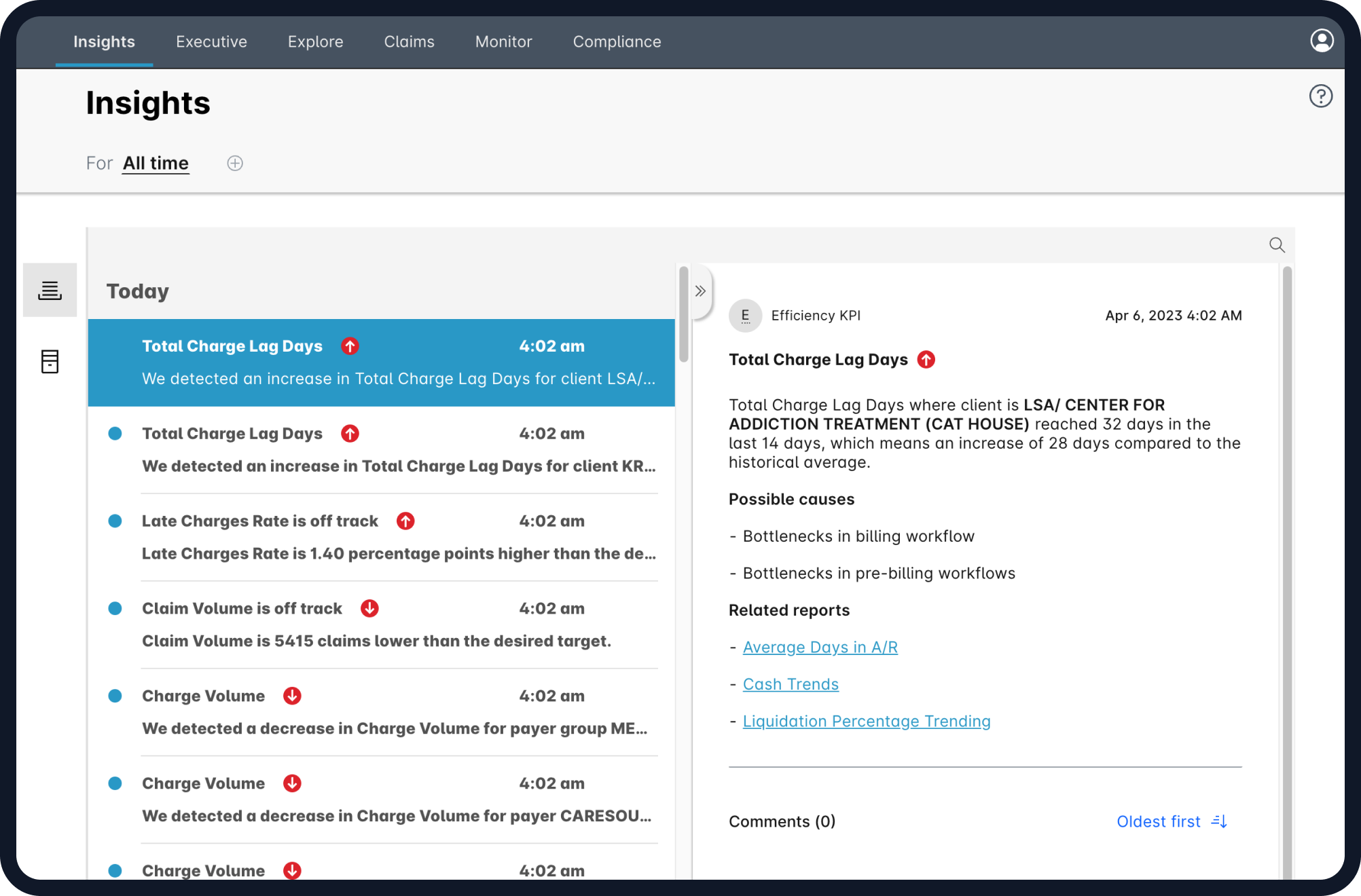

Identify, and prevent issues that lead to decreased revenue performance

Revenue Monitoring

Predictive Adjudication & Payer Reimbursement Monitoring

Commercial Analytics

Commercial Analytics to Drive Profitable Golume Growth

Underpayment Detection

Underpayment Detection of Claims for On-Time Appeals

Resources

-

Revenue Cycle Assessment Identify, and prevent issues that lead to decreased revenue performanceRevenue Monitoring Predictive Adjudication & Payer Reimbursement MonitoringCommercial Analytics Commercial Analytics to Drive Profitable Golume GrowthUnderpayment Detection Underpayment Detection of Claims for On-Time Appeals